アルファを用いたマーケットメイキング - オーダーブックの不均衡

概要

オーダーブックの不均衡、またはオーダーフローの不均衡は、取引フローとともに分析されることが多い広く認識されたミクロ構造指標です。この概念には、マイクロプライス、VAMP(ボリューム調整ミッドプライス)、加重深度オーダーブック価格、静的オーダーブック不均衡など、いくつかの派生があります。これらの派生は、標準化などの統計的調整を受けることもあります。これらの指標に関する詳細な情報はオンラインで広く入手可能です。以下の例では、これらの指標を示します。

参考文献

注: この例は教育目的のみであり、高頻度マーケットメイキングスキームの効果的な戦略を示しています。すべてのバックテストは、Binance Futuresで利用可能な最高のマーケットメイカーリベートである0.005%のリベートに基づいています。詳細については、Binance Upgrades USDⓢ-Margined Futures Liquidity Provider Program を参照してください。

[1]:

import numpy as np

from numba import njit, uint64

from numba.typed import Dict

from hftbacktest import (

BacktestAsset,

ROIVectorMarketDepthBacktest,

GTX,

LIMIT,

BUY,

SELL,

BUY_EVENT,

SELL_EVENT,

Recorder

)

from hftbacktest.stats import LinearAssetRecord

@njit

def obi_mm(

hbt,

stat,

half_spread,

skew,

c1,

looking_depth,

interval,

window,

order_qty_dollar,

max_position_dollar,

grid_num,

grid_interval,

roi_lb,

roi_ub

):

asset_no = 0

imbalance_timeseries = np.full(30_000_000, np.nan, np.float64)

tick_size = hbt.depth(0).tick_size

lot_size = hbt.depth(0).lot_size

t = 0

roi_lb_tick = int(round(roi_lb / tick_size))

roi_ub_tick = int(round(roi_ub / tick_size))

while hbt.elapse(interval) == 0:

hbt.clear_inactive_orders(asset_no)

depth = hbt.depth(asset_no)

position = hbt.position(asset_no)

orders = hbt.orders(asset_no)

best_bid = depth.best_bid

best_ask = depth.best_ask

mid_price = (best_bid + best_ask) / 2.0

sum_ask_qty = 0.0

from_tick = max(depth.best_ask_tick, roi_lb_tick)

upto_tick = min(int(np.floor(mid_price * (1 + looking_depth) / tick_size)), roi_ub_tick)

for price_tick in range(from_tick, upto_tick):

sum_ask_qty += depth.ask_depth[price_tick - roi_lb_tick]

sum_bid_qty = 0.0

from_tick = min(depth.best_bid_tick, roi_ub_tick)

upto_tick = max(int(np.ceil(mid_price * (1 - looking_depth) / tick_size)), roi_lb_tick)

for price_tick in range(from_tick, upto_tick, -1):

sum_bid_qty += depth.bid_depth[price_tick - roi_lb_tick]

imbalance_timeseries[t] = sum_bid_qty - sum_ask_qty

# Standardizes the order book imbalance timeseries for a given window

m = np.nanmean(imbalance_timeseries[max(0, t + 1 - window):t + 1])

s = np.nanstd(imbalance_timeseries[max(0, t + 1 - window):t + 1])

alpha = np.divide(imbalance_timeseries[t] - m, s)

#--------------------------------------------------------

# Computes bid price and ask price.

order_qty = max(round((order_qty_dollar / mid_price) / lot_size) * lot_size, lot_size)

fair_price = mid_price + c1 * alpha

normalized_position = position / order_qty

reservation_price = fair_price - skew * normalized_position

bid_price = min(np.round(reservation_price - half_spread), best_bid)

ask_price = max(np.round(reservation_price + half_spread), best_ask)

bid_price = np.floor(bid_price / tick_size) * tick_size

ask_price = np.ceil(ask_price / tick_size) * tick_size

#--------------------------------------------------------

# Updates quotes.

# Creates a new grid for buy orders.

new_bid_orders = Dict.empty(np.uint64, np.float64)

if position * mid_price < max_position_dollar and np.isfinite(bid_price):

for i in range(grid_num):

bid_price_tick = round(bid_price / tick_size)

# order price in tick is used as order id.

new_bid_orders[uint64(bid_price_tick)] = bid_price

bid_price -= grid_interval

# Creates a new grid for sell orders.

new_ask_orders = Dict.empty(np.uint64, np.float64)

if position * mid_price > -max_position_dollar and np.isfinite(ask_price):

for i in range(grid_num):

ask_price_tick = round(ask_price / tick_size)

# order price in tick is used as order id.

new_ask_orders[uint64(ask_price_tick)] = ask_price

ask_price += grid_interval

order_values = orders.values();

while order_values.has_next():

order = order_values.get()

# Cancels if a working order is not in the new grid.

if order.cancellable:

if (

(order.side == BUY and order.order_id not in new_bid_orders)

or (order.side == SELL and order.order_id not in new_ask_orders)

):

hbt.cancel(asset_no, order.order_id, False)

for order_id, order_price in new_bid_orders.items():

# Posts a new buy order if there is no working order at the price on the new grid.

if order_id not in orders:

hbt.submit_buy_order(asset_no, order_id, order_price, order_qty, GTX, LIMIT, False)

for order_id, order_price in new_ask_orders.items():

# Posts a new sell order if there is no working order at the price on the new grid.

if order_id not in orders:

hbt.submit_sell_order(asset_no, order_id, order_price, order_qty, GTX, LIMIT, False)

t += 1

if t >= len(imbalance_timeseries):

raise Exception

# Records the current state for stat calculation.

stat.record(hbt)

[2]:

%%time

roi_lb = 10000

roi_ub = 50000

latency_data = np.concatenate(

[np.load('latency/live_order_latency_{}.npz'.format(date))['data'] for date in range(20230501, 20230532)]

)

asset = (

BacktestAsset()

.data(['data2/btcusdt_{}.npz'.format(date) for date in range(20230501, 20230532)])

.initial_snapshot('data2/btcusdt_20230430_eod.npz')

.linear_asset(1.0)

.intp_order_latency(latency_data)

.power_prob_queue_model(2)

.no_partial_fill_exchange()

.trading_value_fee_model(-0.00005, 0.0007)

.tick_size(0.1)

.lot_size(0.001)

.roi_lb(roi_lb)

.roi_ub(roi_ub)

)

hbt = ROIVectorMarketDepthBacktest([asset])

recorder = Recorder(1, 30_000_000)

half_spread = 80

skew = 3.5

c1 = 160

depth = 0.025 # 2.5% from the mid price

interval = 1_000_000_000 # 1s

window = 3_600_000_000_000 / interval # 1hour

order_qty_dollar = 50_000

max_position_dollar = order_qty_dollar * 50

grid_num = 1

grid_interval = hbt.depth(0).tick_size

obi_mm(

hbt,

recorder.recorder,

half_spread,

skew,

c1,

depth,

interval,

window,

order_qty_dollar,

max_position_dollar,

grid_num,

grid_interval,

roi_lb,

roi_ub

)

hbt.close()

recorder.to_npz('stats/obi_btcusdt.npz')

CPU times: user 32min 23s, sys: 43.9 s, total: 33min 7s

Wall time: 33min 5s

[3]:

data = np.load('stats/obi_btcusdt.npz')['0']

stats = (

LinearAssetRecord(data)

.resample('5m')

.stats(book_size=2_500_000)

)

stats.summary()

[3]:

shape: (1, 11)

| start | end | SR | Sortino | Return | MaxDrawdown | DailyNumberOfTrades | DailyTurnover | ReturnOverMDD | ReturnOverTrade | MaxPositionValue |

|---|---|---|---|---|---|---|---|---|---|---|

| datetime[μs] | datetime[μs] | f64 | f64 | f64 | f64 | f64 | f64 | f64 | f64 | f64 |

| 2023-05-01 00:00:00 | 2023-05-30 23:55:00 | 10.829336 | 13.5994 | 0.342371 | 0.037249 | 4119.876838 | 82.397448 | 9.191522 | 0.000139 | 2.6383e6 |

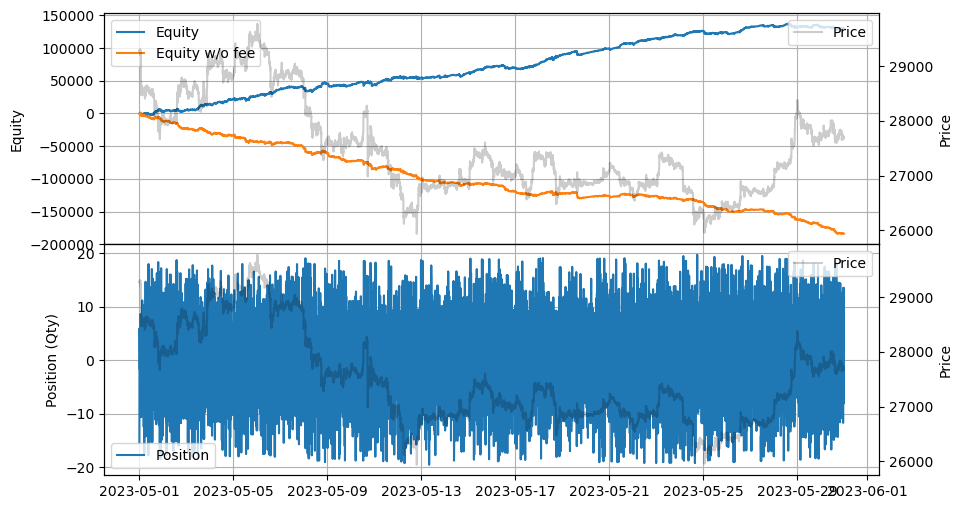

[4]:

stats.plot()

[5]:

%%time

roi_lb = 0

roi_ub = 3000

latency_data = np.concatenate(

[np.load('latency/live_order_latency_{}.npz'.format(date))['data'] for date in range(20230501, 20230532)]

)

asset = (

BacktestAsset()

.data(['data2/ethusdt_{}.npz'.format(date) for date in range(20230501, 20230532)])

.initial_snapshot('data2/ethusdt_20230430_eod.npz')

.linear_asset(1.0)

.intp_order_latency(latency_data)

.power_prob_queue_model(2)

.no_partial_fill_exchange()

.trading_value_fee_model(-0.00005, 0.0007)

.tick_size(0.01)

.lot_size(0.001)

.roi_lb(roi_lb)

.roi_ub(roi_ub)

)

hbt = ROIVectorMarketDepthBacktest([asset])

recorder = Recorder(1, 30_000_000)

half_spread = 5

skew = 0.2

c1 = 10

depth = 0.025 # 2.5% from the mid price

interval = 1_000_000_000 # 1s

window = 3_600_000_000_000 / interval # 1hour

order_qty_dollar = 50_000

max_position_dollar = order_qty_dollar * 50

grid_num = 1

grid_interval = hbt.depth(0).tick_size

obi_mm(

hbt,

recorder.recorder,

half_spread,

skew,

c1,

depth,

interval,

window,

order_qty_dollar,

max_position_dollar,

grid_num,

grid_interval,

roi_lb,

roi_ub

)

hbt.close()

recorder.to_npz('stats/obi_ethusdt.npz')

CPU times: user 27min 37s, sys: 38.3 s, total: 28min 15s

Wall time: 28min 16s

[6]:

data = np.load('stats/obi_ethusdt.npz')['0']

stats = (

LinearAssetRecord(data)

.resample('5m')

.stats(book_size=2_500_000)

)

stats.summary()

[6]:

shape: (1, 11)

| start | end | SR | Sortino | Return | MaxDrawdown | DailyNumberOfTrades | DailyTurnover | ReturnOverMDD | ReturnOverTrade | MaxPositionValue |

|---|---|---|---|---|---|---|---|---|---|---|

| datetime[μs] | datetime[μs] | f64 | f64 | f64 | f64 | f64 | f64 | f64 | f64 | f64 |

| 2023-05-01 00:00:00 | 2023-05-31 23:55:00 | 9.017874 | 11.140311 | 0.299582 | 0.055187 | 4112.621933 | 82.252375 | 5.428451 | 0.000118 | 2.6036e6 |

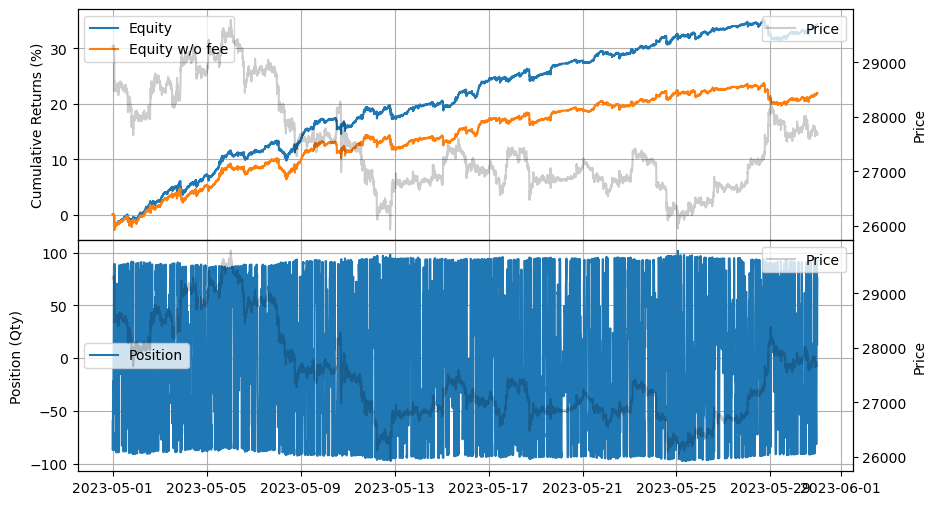

[7]:

stats.plot()

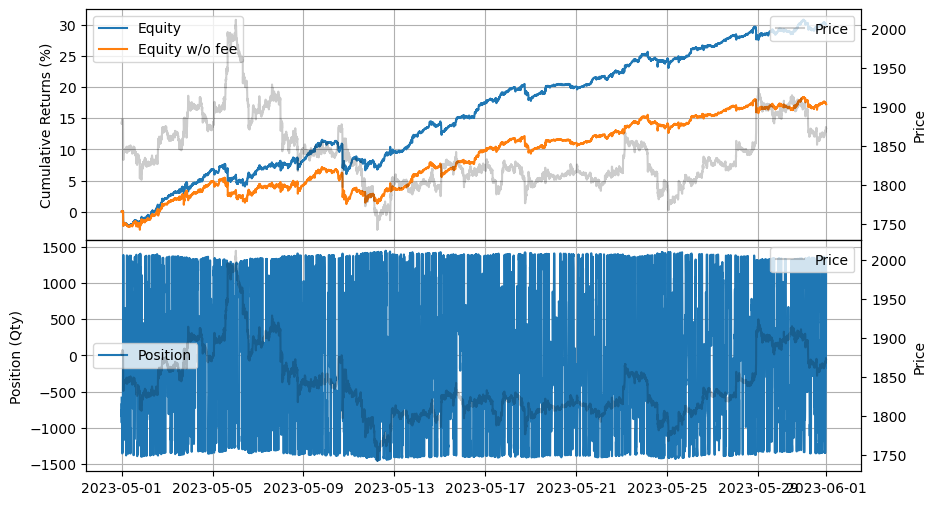

別のアプローチとして、市場メーカーとしての資格を得てリベートを受け取るために取引量を生成する方法があります。この戦略では、高いスキューとタイトなスプレッドを維持します。戦略自体が利益を生まないか、損失を被る可能性がある場合でも、市場メーカーの地位を達成するのに役立ちます。

[8]:

%%time

roi_lb = 10000

roi_ub = 50000

latency_data = np.concatenate(

[np.load('latency/live_order_latency_{}.npz'.format(date))['data'] for date in range(20230501, 20230532)]

)

asset = (

BacktestAsset()

.data(['data2/btcusdt_{}.npz'.format(date) for date in range(20230501, 20230532)])

.initial_snapshot('data2/btcusdt_20230430_eod.npz')

.linear_asset(1.0)

.intp_order_latency(latency_data)

.power_prob_queue_model(2)

.no_partial_fill_exchange()

.trading_value_fee_model(-0.00005, 0.0007)

.tick_size(0.1)

.lot_size(0.001)

.roi_lb(roi_lb)

.roi_ub(roi_ub)

)

hbt = ROIVectorMarketDepthBacktest([asset])

recorder = Recorder(1, 30_000_000)

half_spread = 10

skew = 2

c1 = 20

depth = 0.001 # 0.1% from the mid price

interval = 500_000_000 # 500ms

window = 600_000_000_000 / interval # 10min

order_qty_dollar = 25_000

max_position_dollar = order_qty_dollar * 20

grid_num = 1

grid_interval = hbt.depth(0).tick_size

obi_mm(

hbt,

recorder.recorder,

half_spread,

skew,

c1,

depth,

interval,

window,

order_qty_dollar,

max_position_dollar,

grid_num,

grid_interval,

roi_lb,

roi_ub

)

recorder.to_npz('stats/obi_vg_btcusdt.npz')

CPU times: user 30min 13s, sys: 44.1 s, total: 30min 57s

Wall time: 31min 2s

[9]:

data = np.load('stats/obi_vg_btcusdt.npz')['0']

stats = (

LinearAssetRecord(data)

.resample('5m')

.stats()

)

stats.summary()

[9]:

shape: (1, 11)

| start | end | SR | Sortino | Return | MaxDrawdown | DailyNumberOfTrades | DailyTradingValue | ReturnOverMDD | ReturnOverTrade | MaxPositionValue |

|---|---|---|---|---|---|---|---|---|---|---|

| datetime[μs] | datetime[μs] | f64 | f64 | f64 | f64 | f64 | f64 | f64 | f64 | f64 |

| 2023-05-01 00:00:00 | 2023-05-30 23:55:00 | 14.011326 | 17.369939 | 129920.543525 | 9279.613145 | 8368.335224 | 2.0921e8 | 14.000642 | 0.000021 | 536859.7998 |

[10]:

stats.plot()