レベル3バックテスト

HftBacktestのレベル3フィードデータは、DataBentoのCME Market-By-Orderデータから構築されています

[1]:

from hftbacktest.data.utils import databento

for date in range(20240609, 20240615):

databento.convert(f'data/db/glbx-mdp3-{date}.mbo.dbn.zst', 'BTCM4', output_filename=f'data/BTCM4_{date}_l3.npz')

Correcting the latency

Correcting the event order

Saving to data/BTCM4_20240609_l3.npz

Correcting the latency

Correcting the event order

Saving to data/BTCM4_20240610_l3.npz

Correcting the latency

Correcting the event order

Saving to data/BTCM4_20240611_l3.npz

Correcting the latency

Correcting the event order

Saving to data/BTCM4_20240612_l3.npz

Correcting the latency

Correcting the event order

Saving to data/BTCM4_20240613_l3.npz

Correcting the latency

Correcting the event order

Saving to data/BTCM4_20240614_l3.npz

[2]:

import numpy as np

from numba import njit, uint64, float64

from numba.typed import Dict

from hftbacktest import BUY, SELL, GTC, LIMIT

@njit

def gridtrading(hbt, recorder, skew):

asset_no = 0

tick_size = hbt.depth(asset_no).tick_size

grid_num = 10

max_position = 5

grid_interval = tick_size * 1

half_spread = tick_size * 0.4

# Running interval in nanoseconds.

while hbt.elapse(100_000_000) == 0:

# Clears cancelled, filled or expired orders.

hbt.clear_inactive_orders(asset_no)

depth = hbt.depth(asset_no)

position = hbt.position(asset_no)

orders = hbt.orders(asset_no)

best_bid = depth.best_bid

best_ask = depth.best_ask

mid_price = (best_bid + best_ask) / 2.0

order_qty = 1 # np.round(notional_order_qty / mid_price / hbt.depth(asset_no).lot_size) * hbt.depth(asset_no).lot_size

# The personalized price that considers skewing based on inventory risk is introduced,

# which is described in the well-known Stokov-Avalleneda market-making paper.

# https://math.nyu.edu/~avellane/HighFrequencyTrading.pdf

alpha = 0

reservation_price = mid_price + alpha - skew * tick_size * position

# Since our price is skewed, it may cross the spread. To ensure market making and avoid crossing the spread,

# limit the price to the best bid and best ask.

bid_price = np.minimum(reservation_price - half_spread, best_bid)

ask_price = np.maximum(reservation_price + half_spread, best_ask)

# Aligns the prices to the grid.

bid_price = np.floor(bid_price / grid_interval) * grid_interval

ask_price = np.ceil(ask_price / grid_interval) * grid_interval

#--------------------------------------------------------

# Updates quotes.

# Creates a new grid for buy orders.

new_bid_orders = Dict.empty(np.uint64, np.float64)

if position < max_position and np.isfinite(bid_price): # position * mid_price < max_notional_position

for i in range(grid_num):

bid_price_tick = round(bid_price / tick_size)

# order price in tick is used as order id.

new_bid_orders[uint64(bid_price_tick)] = bid_price

bid_price -= grid_interval

# Creates a new grid for sell orders.

new_ask_orders = Dict.empty(np.uint64, np.float64)

if position > -max_position and np.isfinite(ask_price): # position * mid_price > -max_notional_position

for i in range(grid_num):

ask_price_tick = round(ask_price / tick_size)

# order price in tick is used as order id.

new_ask_orders[uint64(ask_price_tick)] = ask_price

ask_price += grid_interval

order_values = orders.values();

while order_values.has_next():

order = order_values.get()

# Cancels if a working order is not in the new grid.

if order.cancellable:

if (

(order.side == BUY and order.order_id not in new_bid_orders)

or (order.side == SELL and order.order_id not in new_ask_orders)

):

hbt.cancel(asset_no, order.order_id, False)

for order_id, order_price in new_bid_orders.items():

# Posts a new buy order if there is no working order at the price on the new grid.

if order_id not in orders:

hbt.submit_buy_order(asset_no, order_id, order_price, order_qty, GTC, LIMIT, False)

for order_id, order_price in new_ask_orders.items():

# Posts a new sell order if there is no working order at the price on the new grid.

if order_id not in orders:

hbt.submit_sell_order(asset_no, order_id, order_price, order_qty, GTC, LIMIT, False)

# Records the current state for stat calculation.

recorder.record(hbt)

return True

[3]:

from hftbacktest import BacktestAsset, ROIVectorMarketDepthBacktest, Recorder

asset = (

BacktestAsset()

.data([

'data/BTCM4_20240609_l3.npz',

'data/BTCM4_20240610_l3.npz',

'data/BTCM4_20240611_l3.npz',

'data/BTCM4_20240612_l3.npz',

'data/BTCM4_20240613_l3.npz',

'data/BTCM4_20240614_l3.npz',

])

.linear_asset(5)

.constant_latency(100_000, 100_000)

.l3_fifo_queue_model()

.no_partial_fill_exchange()

.trading_qty_fee_model(5, 5)

.tick_size(5)

.lot_size(1)

.roi_lb(0.0)

.roi_ub(100000.0)

)

hbt = ROIVectorMarketDepthBacktest([asset])

recorder = Recorder(1, 5_000_0000)

[4]:

%%time

gridtrading(hbt, recorder.recorder, 0.5)

_ = hbt.close()

CPU times: user 35.6 s, sys: 336 ms, total: 35.9 s

Wall time: 32.4 s

[5]:

from hftbacktest.stats import LinearAssetRecord

stats = LinearAssetRecord(recorder.get(0)).contract_size(5).stats(book_size=1_000_000)

l3_backtest_equity = stats.entire['equity_wo_fee']

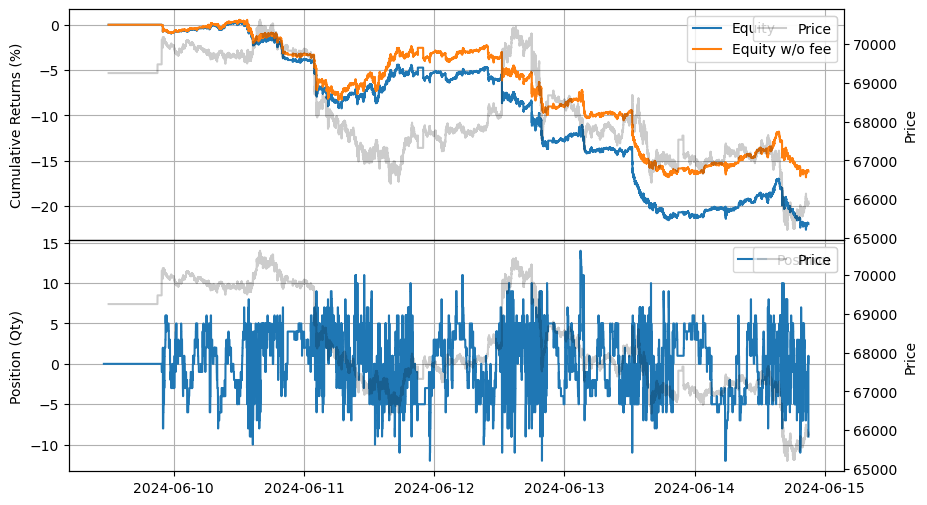

stats.plot()

次のコードは、レベル3データからレベル2データを構築し、レベル3とレベル2のバックテスト結果を比較するためのものです。レベル2はモデルを使用してキュー位置を推定しますが、レベル3は注文データから直接キュー位置を決定します。

[6]:

from hftbacktest.data import correct_event_order, validate_event_order

from hftbacktest import (

EXCH_EVENT,

LOCAL_EVENT,

TRADE_EVENT,

DEPTH_EVENT,

DEPTH_CLEAR_EVENT,

ADD_ORDER_EVENT,

MODIFY_ORDER_EVENT,

CANCEL_ORDER_EVENT,

FILL_EVENT,

BUY_EVENT,

SELL_EVENT,

event_dtype

)

from numba.experimental import jitclass

from numba.types import DictType, int64

@jitclass

class L3MarketDepth:

bid_depth: DictType(int64, float64)

ask_depth: DictType(int64, float64)

order_book_px: DictType(uint64, float64)

order_book_qty: DictType(uint64, float64)

tick_size: float64

def __init__(self, tick_size):

self.bid_depth = Dict.empty(int64, float64)

self.ask_depth = Dict.empty(int64, float64)

self.order_book_px = Dict.empty(uint64, float64)

self.order_book_qty = Dict.empty(uint64, float64)

self.tick_size = tick_size

def add_order(self, ev):

if ev.order_id in self.order_book_qty:

print('add_order: OrderIdExist', ev.order_id)

raise ValueError

self.order_book_px[ev.order_id] = ev.px;

l2_ev = np.empty(1, event_dtype)

l2_ev[0] = ev

l2_ev[0].ev = (l2_ev[0].ev & ~0xff) | DEPTH_EVENT

price_tick = int(round(ev.px / self.tick_size))

if ev.ev & BUY_EVENT == BUY_EVENT:

self.order_book_qty[ev.order_id] = ev.qty;

if price_tick not in self.bid_depth:

self.bid_depth[price_tick] = 0.0

self.bid_depth[price_tick] += ev.qty

l2_ev[0].qty = round(self.bid_depth[price_tick])

elif ev.ev & SELL_EVENT == SELL_EVENT:

self.order_book_qty[ev.order_id] = -ev.qty;

if price_tick not in self.ask_depth:

self.ask_depth[price_tick] = 0.0

self.ask_depth[price_tick] += ev.qty

l2_ev[0].qty = round(self.ask_depth[price_tick])

return l2_ev[0]

def modify_order(self, ev):

if ev.order_id not in self.order_book_qty:

print('modify_order: OrderNotFound', ev.order_id)

raise ValueError

prev_px = self.order_book_px[ev.order_id]

prev_qty = self.order_book_qty[ev.order_id]

l2_ev = np.empty(2, event_dtype)

l2_ev[1] = l2_ev[0] = ev

l2_ev[0].ev = (l2_ev[0].ev & ~0xff) | DEPTH_EVENT

n = 0

if prev_qty > 0:

price_tick = int(round(prev_px / self.tick_size))

self.bid_depth[price_tick] -= prev_qty

if int(round(prev_px / self.tick_size)) != int(round(ev.px / self.tick_size)):

l2_ev[0].px = prev_px

l2_ev[0].qty = round(self.bid_depth[price_tick])

n = 1

elif prev_qty < 0:

price_tick = int(round(prev_px / self.tick_size))

self.ask_depth[price_tick] -= np.abs(prev_qty)

if int(round(prev_px / self.tick_size)) != int(round(ev.px / self.tick_size)):

l2_ev[0].px = prev_px

l2_ev[0].qty = round(self.ask_depth[price_tick])

n = 1

self.order_book_px[ev.order_id] = ev.px;

price_tick = int(round(ev.px / self.tick_size))

if ev.ev & BUY_EVENT == BUY_EVENT:

self.order_book_qty[ev.order_id] = ev.qty;

if price_tick not in self.bid_depth:

self.bid_depth[price_tick] = 0.0

self.bid_depth[price_tick] += ev.qty

l2_ev[n].qty = round(self.bid_depth[price_tick])

elif ev.ev & SELL_EVENT == SELL_EVENT:

self.order_book_qty[ev.order_id] = -ev.qty;

if price_tick not in self.ask_depth:

self.ask_depth[price_tick] = 0.0

self.ask_depth[price_tick] += ev.qty

l2_ev[n].qty = round(self.ask_depth[price_tick])

return l2_ev[:n + 1]

def cancel_order(self, ev):

if ev.order_id not in self.order_book_qty:

print('cancel_order: OrderNotFound', ev.order_id, ev)

raise ValueError

del self.order_book_px[ev.order_id]

del self.order_book_qty[ev.order_id]

l2_ev = np.empty(1, event_dtype)

l2_ev[0] = ev

l2_ev[0].ev = (l2_ev[0].ev & ~0xff) | DEPTH_EVENT

if ev.ev & BUY_EVENT == BUY_EVENT:

price_tick = int(round(ev.px / self.tick_size))

self.bid_depth[price_tick] -= ev.qty

l2_ev[0].qty = round(self.bid_depth[price_tick])

elif ev.ev & SELL_EVENT == SELL_EVENT:

price_tick = int(round(ev.px / self.tick_size))

self.ask_depth[price_tick] -= ev.qty

l2_ev[0].qty = round(self.ask_depth[price_tick])

return l2_ev[0]

def clear(self):

self.order_book_px.clear()

self.order_book_qty.clear()

self.bid_depth.clear()

self.ask_depth.clear()

@njit

def convert_l3_to_l2(data, tick_size):

result = np.empty(len(data) * 4, event_dtype)

local_md = L3MarketDepth(tick_size)

exch_md = L3MarketDepth(tick_size)

rn = 0

for i in range(len(data)):

if data[i].ev & (EXCH_EVENT | LOCAL_EVENT) == EXCH_EVENT | LOCAL_EVENT:

if data[i].ev & 0xff == ADD_ORDER_EVENT:

result[rn] = exch_md.add_order(data[i])

rn += 1

elif data[i].ev & 0xff == MODIFY_ORDER_EVENT:

l2_ev = exch_md.modify_order(data[i])

result[rn] = l2_ev[0]

rn += 1

if len(l2_ev) == 2:

result[rn] = l2_ev[1]

rn += 1

elif data[i].ev & 0xff == CANCEL_ORDER_EVENT:

result[rn] = exch_md.cancel_order(data[i])

rn += 1

elif data[i].ev & 0xff == FILL_EVENT:

continue

elif data[i].ev & 0xff == DEPTH_CLEAR_EVENT:

exch_md.clear()

result[rn] = data[i]

rn += 1

else:

result[rn] = data[i]

rn += 1

else:

# DataBento's CME data is aligned in both local and exchange timestamps.

raise ValueError

return result[:rn]

[7]:

for date in range(20240609, 20240615):

l3 = databento.convert(f'data/db/glbx-mdp3-{date}.mbo.dbn.zst', 'BTCM4')

tick_size = 5

l2 = convert_l3_to_l2(l3, tick_size)

data = correct_event_order(

l2,

np.argsort(l2['exch_ts'], kind='mergesort'),

np.argsort(l2['local_ts'], kind='mergesort')

)

validate_event_order(data)

np.savez_compressed(f'data/BTCM4_{date}_l2.npz', data=data)

Correcting the latency

Correcting the event order

Correcting the latency

Correcting the event order

Correcting the latency

Correcting the event order

Correcting the latency

Correcting the event order

Correcting the latency

Correcting the event order

Correcting the latency

Correcting the event order

[8]:

from hftbacktest import BacktestAsset, ROIVectorMarketDepthBacktest, Recorder

asset = (

BacktestAsset()

.data([

'data/BTCM4_20240609_l2.npz',

'data/BTCM4_20240610_l2.npz',

'data/BTCM4_20240611_l2.npz',

'data/BTCM4_20240612_l2.npz',

'data/BTCM4_20240613_l2.npz',

'data/BTCM4_20240614_l2.npz',

])

.linear_asset(5)

.constant_latency(100_000, 100_000)

.power_prob_queue_model3(3.0)

.no_partial_fill_exchange()

.trading_qty_fee_model(5, 5)

.tick_size(5)

.lot_size(1)

.roi_lb(0.0)

.roi_ub(100000.0)

)

hbt = ROIVectorMarketDepthBacktest([asset])

recorder = Recorder(1, 5_000_0000)

[9]:

%%time

gridtrading(hbt, recorder.recorder, 0.5)

_ = hbt.close()

CPU times: user 28.9 s, sys: 401 ms, total: 29.3 s

Wall time: 24.9 s

[10]:

stats = LinearAssetRecord(recorder.get(0)).contract_size(5).stats(book_size=1_000_000)

l2_backtest_equity = stats.entire['equity_wo_fee']

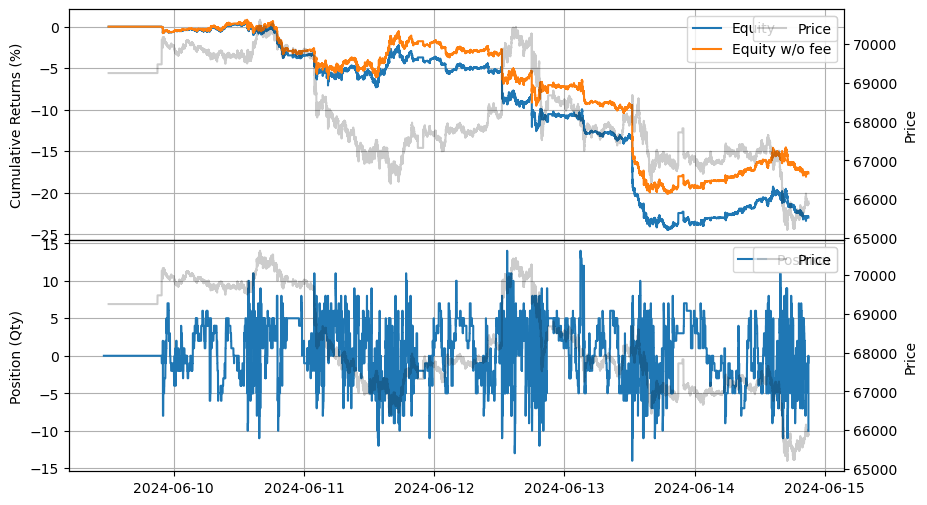

stats.plot()

[11]:

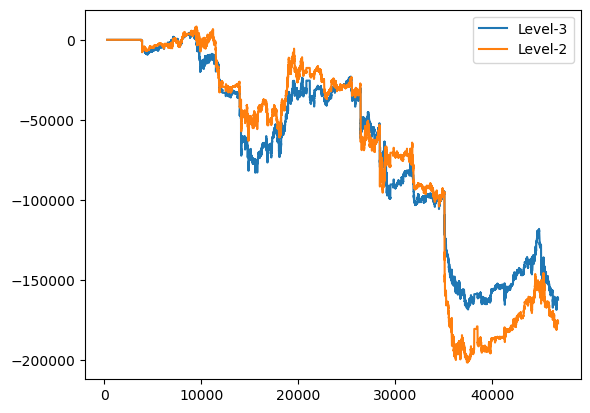

from matplotlib import pyplot as plt

plt.plot(l3_backtest_equity)

plt.plot(l2_backtest_equity)

plt.legend(['Level-3', 'Level-2'])

[11]:

<matplotlib.legend.Legend at 0x7f58f9b4ac20>

この違いの影響は戦略の特性によって異なる場合があります。ある戦略ではレベル2の推定が十分に正確であるかもしれませんが、他の戦略ではそうでないかもしれません。この比較はこれらの違いを強調することを目的としています。レベル2データのみを提供する市場では、ライブ取引データに基づいた現実的なキュー位置モデルを開発することが重要です。レベル3データは直接的な注文キュー位置情報を提供しますが、それでもライブ取引結果に対してバックテスト結果を検証することが重要です。例えば、このCMEレベル3バックテストでは、市場の深さに暗黙の注文が含まれていません。